Many investors turn to gold as a convenient and cost-effective inflation hedge when protecting their savings from inflation. However, is it a good idea to invest in gold? Let’s look at this popular investment option and see if it is truly effective as an inflation hedge.

Here are the Top 3 Reasons You Should Consider Investing in Gold

1) The value of gold has been rising since 2011, reaching over $2,075 (USD) per ounce at its peak.

2) For decades now, people have been telling us that gold is a safe haven asset when markets are going insane. They say it is because gold is a good store of value and not susceptible to high doses of catastrophic events. The 2008 financial crisis destroyed entire economies throughout Europe and Asia. If you buy more gold than you think you can hold, you could increase your wealth by several thousand percent!

3) Conventional predictions about future inflation rates don’t seem reliable these days. Especially when times are looking good for stocks, commodities, and real estate!

Gold did not just protect against inflation

It also gave investors a lucrative hedge against foreign currencies. During the oil price shocks of 1973 and 1979, the price of oil shot up by an average of $15 per barrel. Even though stocks rose simultaneously, many stocks had price volatility during these periods.

Gold was relatively stable thanks to a stronger U.S. dollar, while stocks rose and decreased. Depending on movements in foreign exchange rates (notably crude oil). As a result, gold provided a greater bang for the buck by boosting its volatility relative to other investments.

With unprecedented instability throughout the 1970s and 1980s, gold became an attractive tool for investors around 1980. These trends began to stabilize as monetary policy tightened and economic growth kicked in from that year onward.

This was a lucrative time when value stocks grew at unprecedented rates with solid fundamentals. But found themselves vulnerable due to high valuations left from inflationary episodes from 1973-1979. These results were a perfect match for gold as it further benefited from increased market movement. Between the early 1980s through the mid-1990s since more low-yielding stock market shares existed than high-yielding. Treasury bonds or gold bullion also have volatile returns.

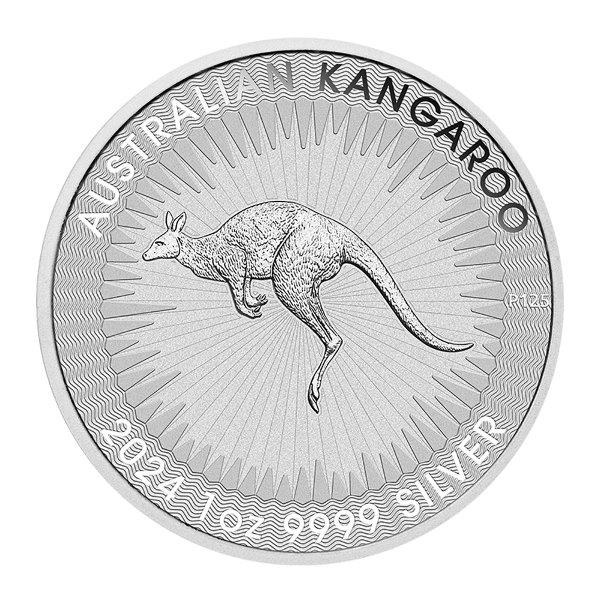

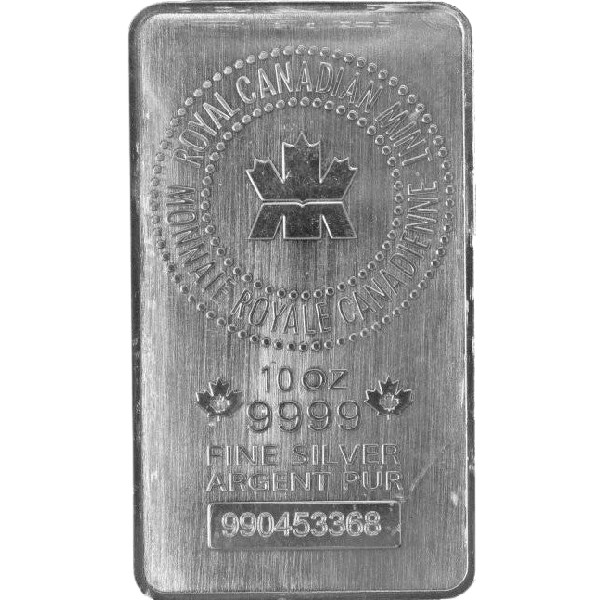

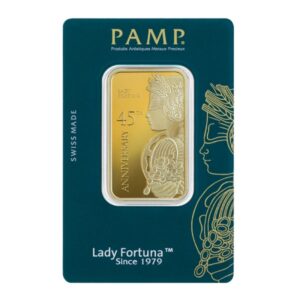

If you are looking for an effective way to hedge against inflation with Gold, you are at the right place. Au Bullion offers a wide variety of Gold bullion products to accommodate to your needs. In addition, we also carry a large variety of Silver bullion and Platinum bullion products too!

Hi,

Hi,